Swyom Alpha India Fund – Q2FY26 Newsletter

Wishing You a Bright and Prosperous Diwali!

As the festival of lights illuminates our surroundings, we hope it also brightens your financial journey. May your investments grow, your decisions be wise, and the year ahead be filled with opportunities and success. Let’s embrace the festive season with optimism and informed choices!

In this edition, we bring you insights on the Global and Indian Economy, a detailed look at the GST 2.0 Implementation, and the Way Forward for India. Additionally, we share our recommendations on sectors to watch in the coming months to help you make informed investment decisions.

Tax Reform Reloaded: How GST 2.0 is Powering Consumption

On the eve of India’s Independence Day, PM Modi announced the changes to GST rate slabs in order to simplify the implementation of GST across different product lines as well as incentivize sectors already impacted by introduction of tariffs. The GST 2.0 reforms saw the removal of 2 slabs of 12% and 28%, and merging them with 5% and 18% for Essential Goods and standard rate of 18% for all other goods respectively.

As the new GST rates were implemented from 22 Sept 2025, we saw the massive discounts and GST benefits for the Automotive industry benefitting in sales figures with Car manufacturers like Maruti selling 30,000 cars, Hyundai selling 11,000 and Tata Motors registering 10,000 sales in a single day on 22nd Sept 2025. Apart from the Automotive sector, the retail oriented Consumption sectors like Consumer Discretionary, Home Appliances, Health and Term Insurance, education sector, Textiles, etc. saw immense benefits being grabbed upon by consumers, newly lured by GST benefits.

The Road Ahead: India’s Growth Story Gains Speed

India’s economic path illuminated by “Atmanirbhar Bharat” campaign is a self sustainable growth oriented development model adopted by our nation. The large population of India on one hand keeps demand levels right up all the time, while the large economic base allows economical production and innovation of cost effective measures to meet domestic demand.

Why we believe in the India Growth story showing long term sustenance?

a) India’s per Capita Income has breached the crucial USD 2,000 levels, long perceived as a barrier to any nation’s consumption drive barrier: At around USD ~2,800 per capita income at market rates, India’s population will be able to both provide for their sustenance as well as aspire for better standard of life while being able to make investments funded by themselves (domestic investments).

b) Demographic dividends: Unlike the ageing population of the developed nations in North America, Western Europe and East Asia, India’s youth population is still younger with median age of 28 and 65% of the population below the age of 35, it presents India an opportunity for both productive labour at economical rates as well as consumption of a lifetime of housing and household requirements, which will benefit the consumption engine of Indian economy from both production and consumption side too.

c) Combined effect of stable democratic Government at the center with an educated population and a wide base for localization of all kinds of industry to fulfil domestic demand: With our vast resources in terms of Land, Labor and Capital, we can initiate and flourish any industry with domestic supply and demand, unlike the likes of other developing nations which are exposed to certain advantage & disadvantage of their overall existence. For example: Bangladesh depended on Textiles, Sri Lanka, Maldives and all of ASEAN nations on Tourism. However, they can’t start or compete in some industries like Automobiles, Metals and Derived / Value Added Engineering Industries, IT industry, Electronics Manufacturing Services, Defense manufacturing, etc, as the gigantic population of India allows domestic companies to operate at a scale that helps them stay competitive against Peers from smaller nations.

Swyom is bullish on India’s Consumption sectors to drive the markets in FY26

While Quarterly earnings saw single digit growth in Q1FY26, and expect similarly dampened earnings for most of the domestic consumption companies, the current Macro scenarios and initiatives taken up by the Government are expected to turn around in H2FY26:

a) Income Tax Cuts / Upgradation of Slabs: We expect the Income Tax relief given up to Rs 12 lakh for Individual taxpayers, will end up increasing the disposable income in hands of individuals. The indirect benefits expected from the Income Tax Cuts are expected to be visible in the Insurance, Consumer Durables, Hospitality, etc, which are related with individual’s standard of living.

b) The GST 2.0: The GST slab changes are expected to have direct impact on Automobiles, Consumer Durables, FMCG, Textiles, etc. As per the market reports, we are already seeing that clubbing the GST benefits with Dealer discounts, end user vehicle prices have fallen by 8-10% on an average, thereby allowing higher sales Volumes for the OEMs. Our Top Picks among them are: M&M, TVS, Maruti Suzuki.

c) Repo Rate Cuts: Though the Corporate Credit Growth rates have fallen to single digits over the last couple of years even prior to the Covid, we believe the time is ripe for Corporate Capex driven Credit growth as the Cost of Funds have come to new lows, much lower than pre Covid Cost of Fund for Banks. With the newer segments like Affordable Housing and Small Finance Banks, apart from the NBFCs who fulfilled the last mile funding, the traditional larger banks are expected to turn around in terms of Profitability, and hence forth in Valuation as well.

Lights, Festivities & Growth: Markets Sparkle This Season

The domestic economy is flying high amidst the GST 2.0 slab reductions implemented from 22nd Sept 2025 with consumable products like, Home Appliances, Automobiles, Jewellery, Insurance, FMCG, Textiles, etc. We believe 3 sectors/industries will witness post best turnouts during the Festive season / quarter.

•Automobiles & Auto Ancillary: GST benefits clubbed with festive discounts by most Automobile OEMs lasting till Oct end / Diwali holidays which have caused an effective price reduction between 8-10% on an average for consumers. The traction in sales volumes and Inventory clearance of some lesser sold models, especially the Hatchback segments, will allow suppliers to the OEMs to restock with fresh Inventories.

•Aviation/Hospitality/QSR: With the festive season at its height continuing throughout the quarter along with early onset of winter wedding season, we expect high domestic Passengers traffic across India. The spike in Air Fares across all airlines will positively reflect in the Earnings of airline companies. Similarly, the Quick Service Restaurants segment will also see massive improvement as the segment swings from Q2 when earnings are dampened as the monsoon seasons doesn’t allow people to step out as much as normally to Q3 quarter, when festivals and weddings across the nation making people go out to dine.

•Consumer Durables / FMCG / Textiles: Consumer Durables sector will see massive boost as the GST 2.0 benefits will be directly passed on to the consumers with off season demand of Refrigerators, ACs, Coolers, and TVs, boosting over the last year. Similarly, the FMCG companies are seeing the GST reduction from 18% to 5%, which has caused both Price hikes taken by the FMCG companies while some volume growth is also expected as lower prices will ease the consumption barrier in terms of Prices.

Global Macro Scenarios & Geo-Politics

The Q2FY26 period marked the introduction of additional tariffs by US President Trumps administration with all their trading partners. While most other nations bogged down under US Admins pressure tactics, and finalized a Trade Deal with the US, India and other member nations from the BRICS forum like China and Brazil have been slapped with additional tariffs, taking the total tariffs on their products up to 50% tariffs.

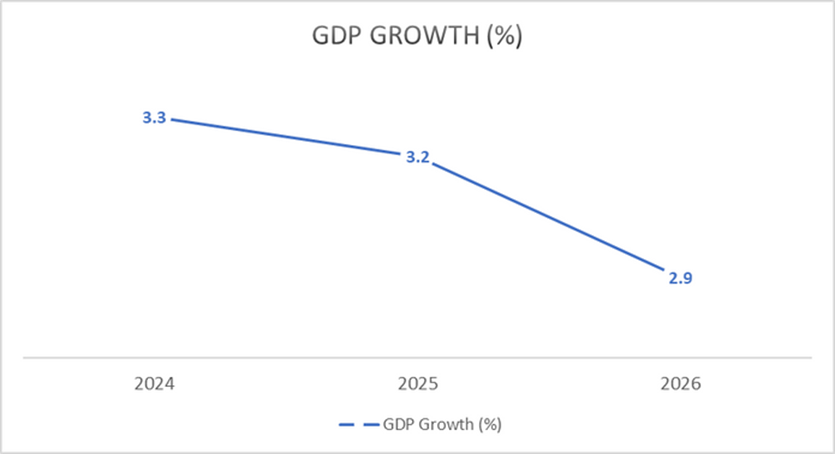

Global GDP Growth Trend (OECD Projection)

The OECD’s Interim Economic Outlook has reduced the GDP growth projection down to 3.2% for 2025 from 3.3% in 2024, and further slide down to 2.9% in 2026. In the US economy, the Unemployment rate stabilized at 4.3% as of August 2025, which comes amidst a 16 year low for the YTD Hiring Plans. The US Feds have already cut policy rates by 25 bps in early Sept, with US Fed Chairman Jerome Powell expressing intentions of the 12-member committee to take 2 more rate cuts either by end of 2025 or early 2026, thereby, bringing it down to 3.5-3.75% levels.

Overall, we are both perplexed as well as thrilled to witness a once in centuries global power tussle, with China currently challenging the USA’s sole superpower status. The Trump administration’s recent tariffs campaign against almost all their trading partners is in all likelihood, the last measures to maintain their hegemonistic style of governance. Hence, India will have be opportunistic for her own good while laying down the foundations for our nation’s self chosen path of strategic sovereignty aligning with our economic aspirations.

Indian Economy

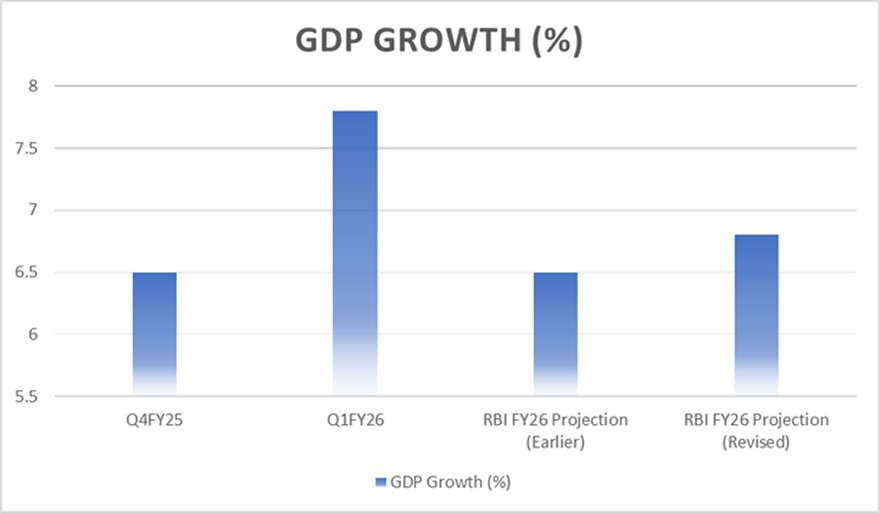

India’s Economy posted a surprisingly humungous growth in the Q1FY26 at 7.8% between July-Sept 2025 period. The Central Bank has projected India’s GDP growth for FY26 to 6.8% from 6.5% (earlier guided).

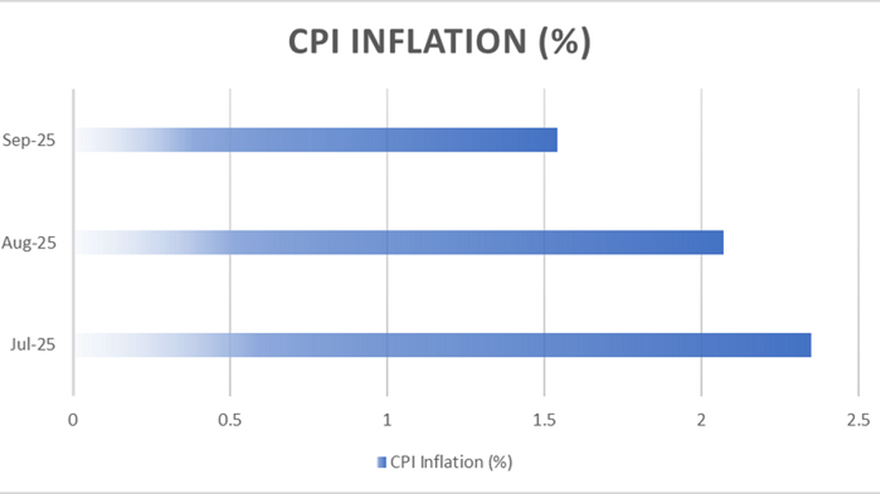

The RBI has been relieved of CPI inflation pressure this year as CPI inflation has cooled down to 1.54% from 2.07% in August 2025, allowing flexibility for the Central Bank on monetary policy decision making.

The HSBC Manufacturing PMI data for the month of Sept 2025 came at 57.7, down from 59.3 in August while the Services PMI came at 60.9, down from August’s 62.9. The massive boom in the Services sector activity is attributed for the GDP growth posted in Q1FY26.

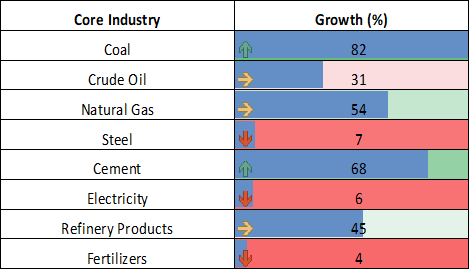

The index of 8 core industries of India also saw growth of 6.3% in August 2025 which includes industries like: Coal, Crude Oil, Natural Gas, Steel, Cement, Electricity, Refinery Products and Fertilizers.

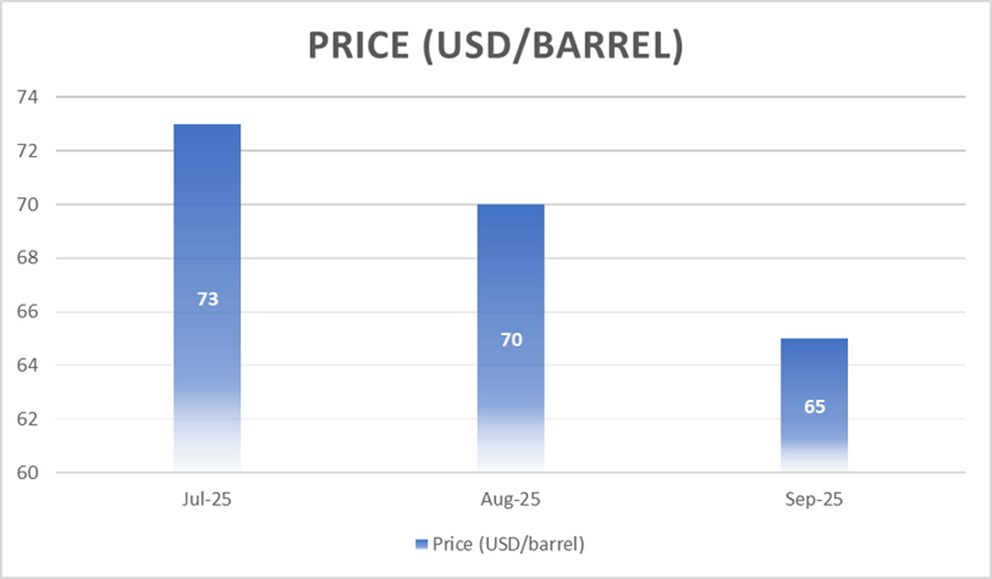

The Brent Crude, which is in the middle of all trade talks between India and western nations, saw a surge in late July crossing over USD 72-73 per bbl, only to succumb to below USD 65 per bbl levels by the end of September.

Disclaimer:

The information contained in this newsletter is for informational and educational purposes only and should not be construed as investment, legal, or tax advice. The data, opinions, and forecasts presented are based on sources believed to be reliable, but Swyom Advisors Limited does not guarantee their accuracy or completeness. Past performance is not indicative of future results. Readers are advised to consult their financial advisor before making any investment decisions. SWYOM and its affiliates shall not be held responsible for any direct or indirect loss arising from the use of this information.