Budget 2025 takes a strong step towards Viksit Bharat by strengthening the core of the economy through historic reforms in taxation, boosts agriculture & MSMEs, ease of doing business, accelerate infrastructure growth, provide strong support to Start-up ecosystem, strengthen India’s position in AI & Innovation. All together a strong move towards the mission of strengthening the manufacturing base and making India competitive globally.

Notable Highlights

- Fastest-growing economy amongst all major global economies.

- Zero Income Tax up to ₹12 Lakh.

- Fiscal deficit estimate reduced to 4.4% in FY26.

- Nominal GDP growth estimated to be 10.1% for FY26 (vs 9.7% projected for FY25).

- Government earmarks Rs 11.21 trillion for capital expenditure in FY26

- Insurance FDI hiked from 74% to 100%

- Rs 1.5 Lakh Crore Additional Credit for MSMEs

- Rs 1 Lakh Crore Urban Challenge Fund for Smart Cities

- Massive Expansion in AI, Healthcare & Education

Our Key Takeaways

Consumption at forefront

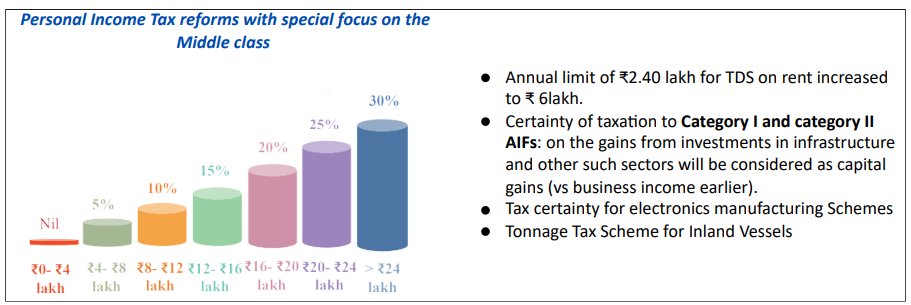

Recognizing that consumption is a major engine of economic growth in India, Budget 2025 prioritizes measures to stimulate spending. The historic taxation reforms, including the simplified tax slabs and increased rebates, are designed to enhance purchasing power, especially for the middle class.

- Increased funding for MSMEs, a significant source of employment, will further contribute to income growth and consumer confidence.

- These combined initiatives are expected to have a ripple effect across various sectors, with Retail, FMCG, QSR, Automotive, and Travel & Tourism poised to benefit significantly.

- This focus on consumption aligns with the broader goal of achieving Viksit Bharat by 2047, as sustained consumer spending is essential for long-term economic development.

Key beneficiary sectors: Retail, FMCG, QSR, Automotive, Travel & Tourism

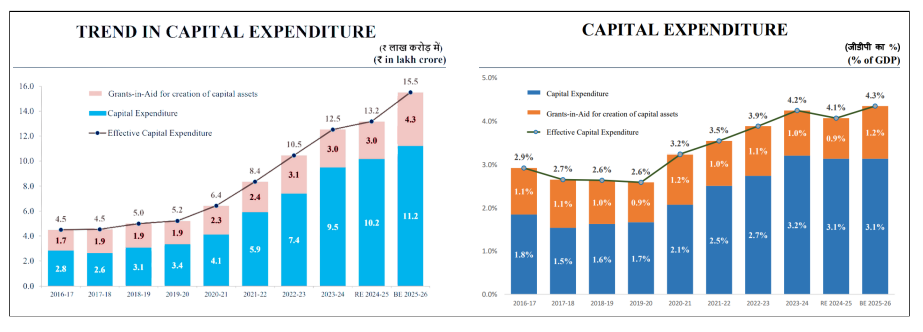

Continued focus on Capex

Budget 2025 reinforces the government’s commitment to using capital expenditure (Capex) as a key driver of economic growth. The substantial allocation of Rs 11.2 lakh crore, a 10% jump over revised estimates, underscores this priority. This investment in infrastructure is expected to have a multiplier effect, creating jobs, stimulating demand, and laying the foundation for long-term economic expansion. The increased Capex is crucial for achieving the 10.1% nominal GDP growth target set for FY26 and aligns with the broader vision of Viksit Bharat.

Key beneficiary sectors: Power, Infrastructure and Urban Development (water infra, roads, railways and clean energy)

Strengthening the House

Budget 2025 lays a solid foundation for economic growth with a projected 10.1% nominal GDP growth in FY26, reaching Rs 356.97 lakh crore. This growth trajectory, coupled with a reduced fiscal deficit target of 4.4% for FY26 (down from the revised 4.8% in FY25), signals a commitment to fiscal responsibility and sustainable economic expansion. This balanced approach is crucial for long-term stability and achieving the goals of Viksit Bharat.

MSME boost

India’s MSMEs are not just small businesses; they are the engine of the nation’s manufacturing sector and a crucial driver of export growth. With over 1 crore registered businesses employing 7.5 crore individuals, they contribute a substantial 36% to manufacturing output and an impressive 45% to exports. Budget 2025 recognizes their strategic importance with targeted support designed to further enhance their competitiveness and global reach.

Key initiatives, including extended credit guarantee cover to improve access to finance, a focus product scheme for the footwear and leather shoe industry to boost exports in these specific sectors, and incentives for food processing and clean tech manufacturing, signal the government’s commitment to nurturing this vital sector.

This focus on MSMEs not only strengthens India’s manufacturing base but also creates attractive investment opportunities in a dynamic and growing segment of the economy.

Key beneficiary sectors: Footwear, Food processing, Power (Solar cells, EV batteries, Turbines, Electrolyzers, EHV transmission equipment)

Customs Duty Rationalization

Customs duty rates are rationalized to support domestic manufacturing, value addition, promote exports, and facilitate trade.

Example: Budget 2025 rationalizes customs duties to enhance competitiveness and attract investment. This boosts domestic manufacturing (17% of GDP), incentivizes higher-value exports (20% of GDP), and simplifies trade, lowering business costs (currently 10% higher than peers – cite source). This creates exciting opportunities in manufacturing and export-oriented sectors, projected to grow by 8% (cite source). Streamlined customs procedures make India a more attractive investment destination.

“With the aim to transform India into a global manufacturing hub, budget 2025 provides the perfect impetus and addresses the right set of areas which shall help achieve the goal. This budget further strengthens our belief in long term growth potential of India & it’s rising global dominance”

Key Reforms

A] Infrastructure and Urban Development

- Urban Challenge Fund: With a budget of Rs 1 lakh crore, this fund will support ‘Cities as Growth Hubs’ and enhance urban infrastructure for water, sanitation, and creative redevelopment. Allocation for 2025-26: Rs 10,000 crore.

- Jal Jeevan Mission Extended until 2028 with aims to provide 100% rural tap water coverage.

- Power Sector Reforms: Incentives for improving financial health and the transmission capacity of electricity distribution companies, with additional borrowing limits contingent on reforms.

- The budget allocates ₹1.5 lakh crore in interest-free loans to states for infrastructure projects, with a special focus on roads, railways, and energy.

- Capex target increased to Rs 11.21 lakh crores (slightly above previous year’s budget of Rs 11.11 lakh crores)

B] MSME’s & Startups

C] Artificial Intelligence & Technology

- AI: INR 500 Crore total outlay for setting up an AI Centers of Excellence

- Science and Engineering: Additional infrastructure in 5 new IITs to facilitate education for 6,500 more students

D] Taxation (New Income Tax Bill to be tabled next week)

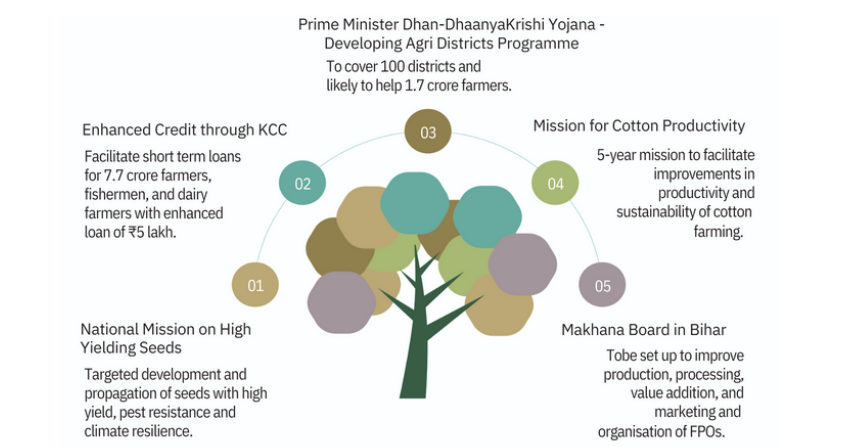

E] Agriculture Growth & Rural Prosperity

Snapshot of Estimates

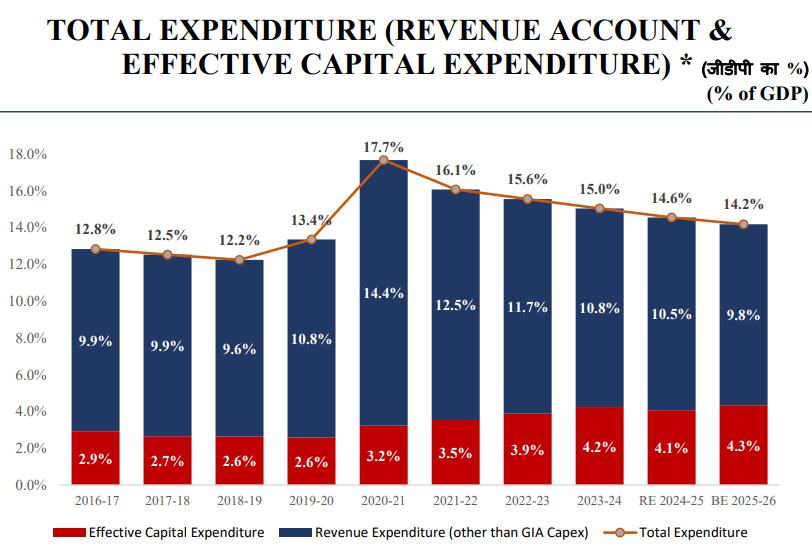

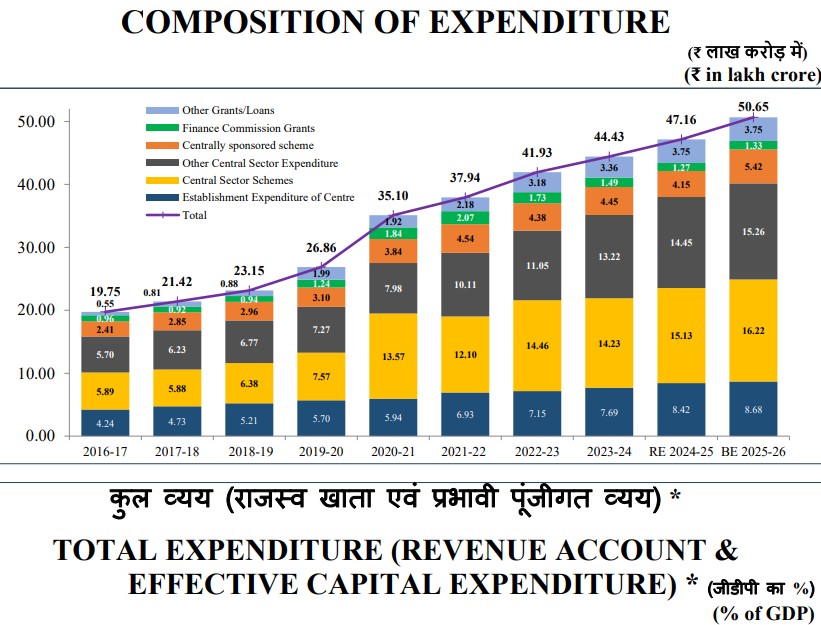

Total Expenditure (% of GDP) Progressively, effective capex (as % of GDP) has increased over the years while expenditure on revenue account (as % of GDP) has come down, indicating improved quality of expenditure

31% rise in Centrally sponsored scheme

shows the commitment of the government to

strengthen the domestic economy & boost

local manufacturing and infrastructure.

An increased expenditure with a declining

Fiscal deficit suggests controlled

borrowing while ensuring adequate

spending, thus, a sustainable growth

environment

Disclaimer:

The information provided in this blog is for informational and educational purposes only and should not be considered as financial, investment, or legal advice. SWYOM does not guarantee any information’s accuracy, completeness, or reliability. Readers are encouraged to conduct their research and consult with a qualified financial advisor before making any investment decisions. SWYOM shall not be held responsible for any financial losses or decisions made based on the content of this blog. Investments are

subject to market risks. Past performance does not guarantee future results.